Wondering how to make a budget? Or just looking for some helpful tips on how to organize your finances? This post should help!!

Are you a regular non-accounting person trying to get a handle on your finances? Or saving up for a dream vacation or a big purchase but don’t know where to start??

I would love to help you!

Because I am the queen of budgets.

And lists.

I have been ever since I had a piggy bank when I was a little girl 😳.

Although my methods were quite basic on my metal Cinderella bank…

In case you are new here (ie – not following me on Instagram and never seen my stories where I complain about tax season 🤷♀️) you might be wondering ‘why in the heck is this lifestyle blogger talking about anything financial’?

My college degree is in economics and every job I have had since I was 18 years old has been in accounting 🤪.

I love formulas and things working out as they should from the formula.

And budgets really are just a very simple formula.

This post will provide some easy tips for you to understand your own finances better and hopefully help you get a clear idea of what your ultimate financial goals are!

Side note- I was mentioning this topic to my husband and his reply was “Make it funny.”

I.E. don’t be all boring and dry and only talk about Quicken.

Soooo – if that is how the rest of this post comes across- I am sorry. Not exactly sure how to liven up the topic of budgets but I will try…

As an Amazon Influencer, I earn from qualifying purchases. Some of the other links on this site are also affiliate links, which means I might earn a small commission if you love something as much as I do at no additional cost to you… but I only recommend what I actually like myself!

Read the full disclosure here.

In a rush?

How to Make a Budget

But First: A Quick Motivational Blurb and My Budget History

Here is the thing about budgets: they do not need to be overwhelming!

In fact – I think people spend more time stressing about THINKING about a budget than actually getting started with making one.

Once you get in the habit of writing your spending habits down – you will be surprised at how quickly you will catch on.

But like anything in life – it will take practice. And vigilance.

You know – kind of like exercising.

Which by the way I am the furthest thing from a queen about 😂.

I started making budgets for my husband and I when he was in grad school and I was pregnant with our first baby.

We were in our mid-20’s and I was just not loving my accounting job at the United Way.

I was struggling to even think about hiring a nanny to watch my new baby as I went to this job I didn’t love. But besides student loans, I was our only income source in grad school…

I was 9 months pregnant when my husband was offered a job teaching anatomy to first year students for $8000 a year!

My prayers had been answered! I sat down and was like – okay we can do this. We can live on this for the next two years of grad school and I can stay home with our new baby.

WE GOT THIS!

And our first budget was born.

I used plain old pencil and paper and started figuring out how we would spend our $8000 a year ;).

To be fair – we lived in student housing and our rent was covered under our student loans. And student health insurance was included with our tuition. And we didn’t start saving for retirement until after all the graduate school years were over.

So all I had to do was figure out how to pay for our car payment, insurance, food, baby products, clothing, and any travel to visit family that we did with $666/month.

How am I just now realizing THAT figure was our monthly income???!!! Seems like we should not have made it with that omen 🤷♀️.

But we did.

Write Your Goals Down

As soon as we got that grad school job offer – I looked at our checking account register (yup – this was wayyyy before computers 😂). And started categorizing on a piece of paper every single thing we had spent money on for the last three months.

I had a column for eating out, groceries, entertainment, clothing, travel, and gas. Then I tallied it up and had to make hard decisions on what was really important to us and what wasn’t.

After that, I made the decision to stay home with our first baby and subsequent two others for the next 18 years.

A simple way for you to think about a budget is as your own private compass for your financial goals.

It can 100% be flexible, it can change as things in your life change.

And most importantly – it is not meant to make you miserable!! I am the first to tell you that life is short and we all need to find that perfect balance between spending and saving…

So my first suggestion for you is to WRITE YOUR FINANCIAL GOALS DOWN! Ideally in a journal that is used strictly for finances so that it is all in one place and easy for you to keep track of. I personally love this grid paper journal.

Speaking of which – I highly suggest you read my post with planning tips as this also applies to finances (obviously)!

You can also use online savings calculators to help get you started on what your goals for future needs like retirement and college will be.

NerdWallet is one of my favorites for every type of financial calculator!

Use Quicken

If you want to know how to make a budget WITHOUT computer software – skip this section and go below.

Once we had a personal computer in our house (which was in 1996 fyi) – budgeting and keeping track of our finances got infinitely easier!

In 1998, I bought the Quicken desktop software and was hooked. I am officially a Quicken-aholic 😂.

I know I have a natural knack for accounting but I am pretty sure this software is very easy to use (let me know if you feel differently in the comments below!).

I tried to set my young adult kids up with Mint.com and even a couple other online budget sites but for me personally – nothing compares to Quicken.

I AM NOT GETTING PAID TO SAY THIS BTW 😂. I have been using their products for over twenty years and just find them simple to learn and understand.

However here is a Forbes article listing some budget apps for you to check out if you don’t want to try Quicken or Mint.com!

Quicken Starter is currently $36/month. This may seem like a lot (especially if you are on a super tight budget). But I 100% believe Quicken is the easiest way to organize your finances ;).

Oh and now a joke to make this post funny in case my husband is reading this post and is getting bored…

Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair. – Sam Ewing

Tips for How To Use Quicken Software

You will enter usernames and passwords from all of your bank accounts into the Quicken software. And then it will easily upload all your checking/savings/credit card transactions into the software for categorizing.

Quicken has been around for centuries and is extremely reliable if you are worried about online protection.

When just starting out – my suggestion would be to start with uploading 90 days of transactions from your banks (Quicken should ask you how far back you would like to upload from your banks).

It will be up to you to customize your categories if you want to add more details than Quicken already has in their system. More on that below!

You will need to make your own budget in Quicken and cleaning up the transaction categorizing will take a bit of time.

Here is the thing – starting with anything will take a bit of work.

You need to be consistent and diligent with the categorizing of each transaction that gets downloaded into Quicken. Otherwise you just bought financial software for no good reason.

Any questions I have EVER had with Quicken have been answered simply by googling it.

More Detail in your Categories

- Insurance

- medical, life, home, and disability

- Auto

- Loan payments, gas, AAA dues, repairs, and registration (the last is a tax write off so it is good to have this separated out so that you can find that information easily for your taxes!)

- Household – for my own information I have many subcategories in this list! Just a few that I want to know specifically how much I have spent on them are:

- Home decor, home repairs, house cleaning

- don’t laugh but I use Amazon SO MUCH nowadays – about two years ago I just decided to give it it’s own category… so I can tell you on any given day how much I have spent on Amazon (please don’t ask -it’s bad…)

- Kids’ Spending – my kids all have my credit card with their names on it for emergencies and school expenses. To their chagrin – I am on Quickbooks daily and see when they use this credit card and if I don’t know what a charge is – I quickly text and say ummmm what’s up??

- This category is divided EVEN further by kid!! No getting away with anything in this house…

- Savings

- 529 savings, regular savings, investment account savings, and retirement savings

- Travel

- Airfare, hotels, ground transportation, meals, and misc

- Gift Giving

- Christmas, birthdays, and Easter

- Utilities

- Gas & electricity, water, internet, telephone, and waste removal

Using these new categories – make a new budget and enter your expected income and expenses in all of these categories

Making a budget in Quicken is easier than it sounds. You don’t need exact numbers. Just best guess will work…

However since you have already uploaded the last 90 days of transactions from your banks and subsequently categorized them, you can use this information for your new budget.

You will use a report called ‘Profit and Loss‘ to help you see how much you have spent per month for each of your categories and can then enter a monthly average in your new budget using those figures.

Make and LOOK at Custom Reports

For a Quicken newbie this might be kinda tricky – but the report you will want to go to the most is called Budgets vs Actuals.

This report right here is exactly why some of you have asked me to write a blog post on budgeting.

It is your main reason for getting Quicken in the first place and is how you are going to stay on track with that budget you created earlier!

If you are having trouble finding it – it is considered a standard report but you can google where in Quicken is my budget vs actuals report.

As I said above – the help information on the Quicken website is truly amazing. I have never not found what I have searched in their help desk.

Jump below to what to do now that you have this budget information to look at!

But first a funny meme so that you aren’t bored 😂 👍🏻:

Making a Budget Without Software:

I have recently been helping a neighbor get his finances in order. And in doing so – I have found some AMAZING budget journals that are incredibly helpful to a newbie budgeter.

I would HIGHLY recommend purchasing one of these journals to help you get started if you plan on using the paper route for budgeting and financial goal making!

Before I started using Quicken and later moved to Quickbooks, I made a spreadsheet using these steps on grid paper. So if you decide to not buy one of the above budget journals, you can use grid paper or an Excel spreadsheet to be successful in making your budget ;).

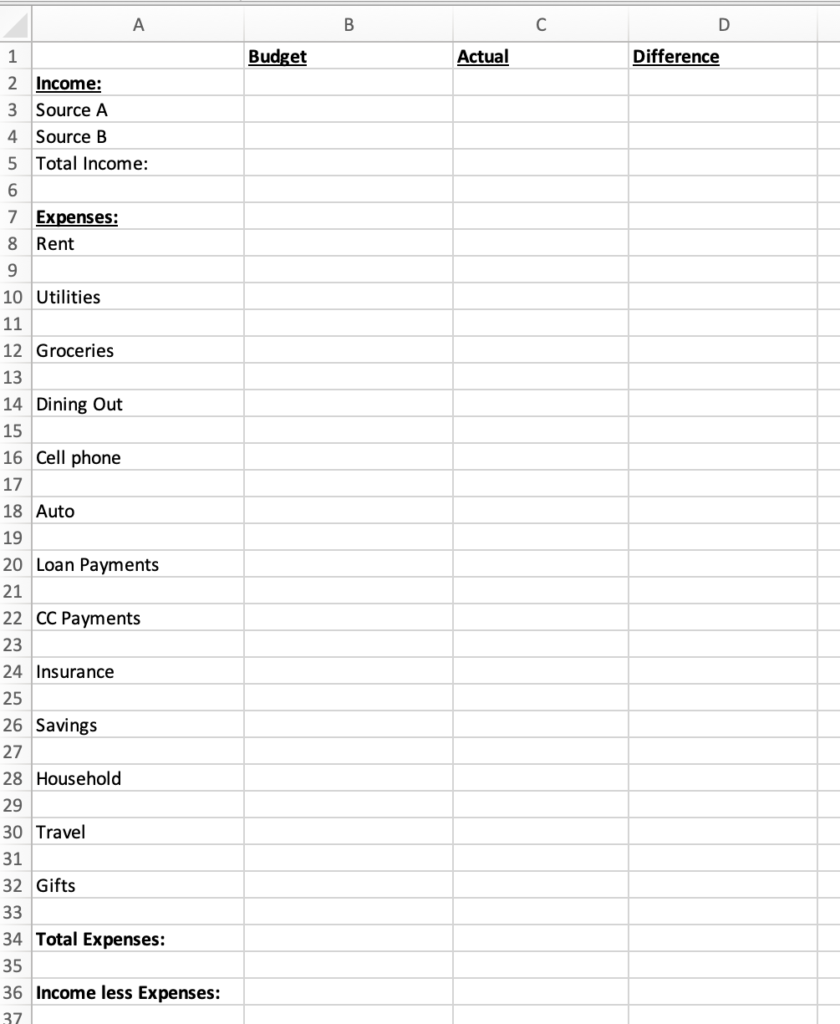

Categorize your Spending

- Look at your previous 3-6 months spending (whether via your bank statements or online) and recognize your main categories of spending. List those categories on the top of a piece of paper (here is where grid paper would be super handy!). Do not be too detailed with these categories. Here are the main categories you should have and you can also use my subcategories listed above:

- Income

- Mortgage or rent

- Utilities

- Groceries

- Dining out

- Cell phone

- Loan payments

- Credit card payments if you do not pay off your card every month

- Savings (see above)

- Auto (see above)

- Insurance (see above)

- Household (see above)

- Travel (see above)

- Gift Giving (see above)

- Clothing

- Personal care (haircuts, waxing, nails)

- Use a separate page for each month of this spending analysis (to get an accurate analysis – use a minimum of 3 months worth of spending).

- As you go through each transaction – whether from your bank statements or online – put each under one of the categories from above that you are using

- Tally up each column by month

Average your Category Totals Per Month

Add the above monthly totals together and then average them based on how many months of details you are using.

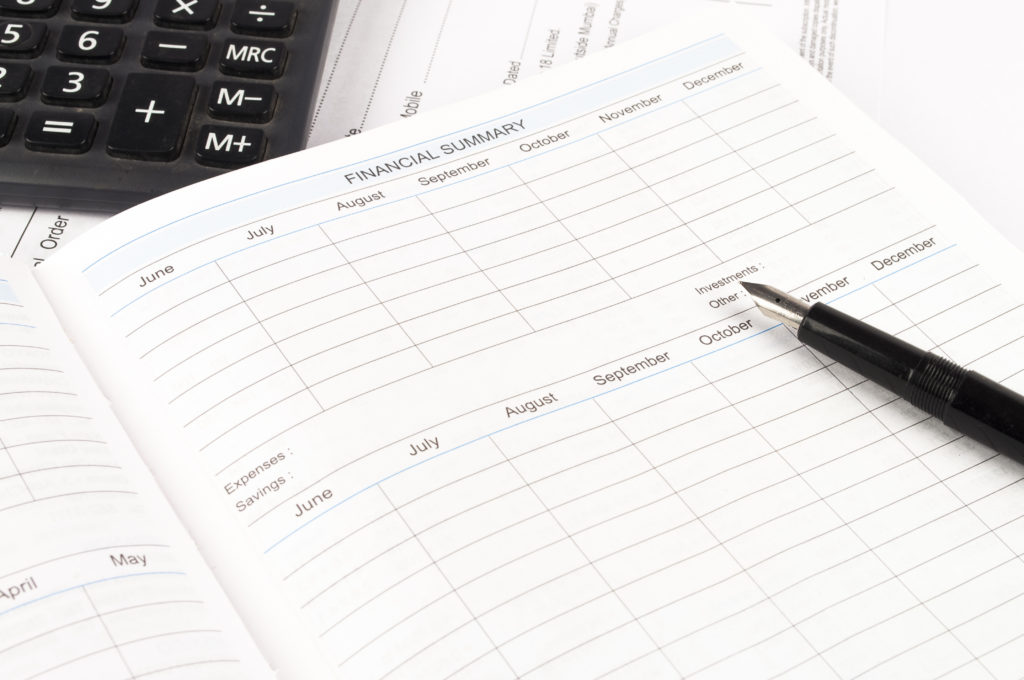

Using these averaged figures, make a yearly budget spreadsheet on a separate piece of paper.

Excel would be very helpful for this spreadsheet if you know how to use that program. It will allow for changes and fixes and moving things around as need be.

But pen and paper always works too!

Here is a simple Office template for you to download as well!

This is what your goal for it to look like would be (minus the subcategories listed above):

Budget vs Actual Report

This report is the key to WHY you made a budget to begin with!

Every month, keep track of your actual spending in each of your chosen categories and then go back to your budget and do the analysis below.

Is your total expenses number bigger than your income?

If the answer is yes – you need to make changes in your spending.

You may have it where some months have a positive net income (income less expenses) and some have a negative net income.

However if your net income for the year is still positive – than good for you!!!!

Celebrate! Your budget is working!

If you need to make spending changes due to a negative income less expenses figure, when you were making that list for the last three months of spending, you likely noticed places you could make those changes.

Every budget article written says – once you have analyzed and written down your spending you will always be shocked to see how those dollars added up in at least one category.

People usually blame a Starbucks addiction (or in my case – a McDonald’s Diet Coke addiction…).

Do you need to start eating out less? Do you need to stop “treating yourself” to those new shoes every month? Or are you buying name brand items when you should be buying generic brands until you figure out how to get your income higher?

Are you spending too much on decor items (this is usually where I look every month and say well clearly I can do better 😂)? Or maybe you are spending money on an adult child and until you tallied it all up you had no idea you were spending that much on them?

Clearly just increasing your income would solve all problems but in today’s economy that is a heck of a lot easier said than done.

Analyze your Progress, Plan Ahead, and Find Balance

Your budget vs actuals report is the key to analyzing your progress.

Questions to ask yourself for your budget analysis:

- What was my biggest win this month?

- Did I meet my budget this month?

- Did I achieve my goals for the month?

- What did I learn this month?

- What should I do next month to meet my goals?

Also part of your analysis should be to make sure you have an emergency fund set up! It is recommended that you have enough saved to cover at minimum three months of necessary expenses (rent, utilities, car payments, food, etc).

Financial goal setting is one of the best planning practices you can work on. Lowering your savings amounts should be the LAST thing you do to meet your budget.

Fifteen years ago, once our student loans were paid off and we were finally settled into our forever house, I made an Excel spreadsheet laying out my savings goals for us. I used an online calculator to figure out how much we will likely need for retirement and college savings and went from there.

So far – we seem to be keeping to those goals ☺️.

I am the first one to tell you life is short- go on the trip!

BUT unless you are told you have limited time left on this earth, you will almost always be better off thinking ahead and being financially prepared for whatever comes your way first 😉.

So be responsible on your planning for that trip or project or whatever fun goal you have set for yourself!

My husband and I like to talk about our life balance alot. We don’t oversave. We don’t have our retirement fund completely funded already.

But we have found balance in our saving and LIVING LIFE. If we learned anything these last couple of years – it’s that absolutely nothing is guaranteed to anyone especially not tomorrow.

So work on that budget, and work on those financial goals, but FIND BALANCE.

If you crave escaping on a vacation – use your budget to find your balance. Your comfort level.

Eat PB&J for a little while if you have to in order to live your dream… trust me – it’s worth it!

Heck- if I can survive with a family of 3 on an $8k/yr income in the late 90’s – you can meet your goals too!

BTW- I have zero regrets with that decision to stay home with my kids. And I have the handy tool of budgeting to thank for that 😊.

If you made it all the way to the end of this post – congrats! Here are my last couple of funnies to reward you and of course – make you smile ;):

I hope this post is helpful and inspiring for you as you learn how to make a budget and (or) organize your finances.

I know it might feel overwhelming at first, but I promise once you get started and make budgeting a habit, you will be so proud of your achievements!!

YOU GOT THIS!!!

Looking for an item that wasn’t linked in this post?

Be sure to check out my ‘Home Tour’ pages!

Did you find this post useful? Pin it to your boards – just click the Pin button in the upper right corner!

Home is where one starts from.

~ T.S. Eliot

Don’t miss any of my tips, inspiration, or stories! Follow me on Instagram, Facebook, and Pinterest!

As always, I love hearing from you!!

I make every effort to reply to every comment below. But if for some reason I missed it – please feel free to contact me here.

Have a wonderful day my friend! I hope something makes you smile today ;).

My 2022 goal is to be debt free by 2023. i have always lived on a budget but am an impulse buyer. so i thank for all the tips. will let you know how i’m doing.